A Deeper Look

The key is in the individual time entries on your legal bills.

In many cases, what clients would call “thieves,” large law firms call “superstars.” But you cannot assume that any lawyer who does work for you is honest or dishonest.

You cannot assume that entire law firms are honest or dishonest. Each lawyer within the firm must be judged individually. You need a way to tell the difference between ethical and unethical attorneys in order to protect your business from being overbilled.

Hey, wait, this “lesson” doesn’t answer any questions, it only raises questions (cue the “typical lawyer” wisecracks). True, but knowing a little more about the underlying motives and morals of attorneys working on your matters and the inner workings of law firms can help you spot overbilling in your legal invoices. How? The key is in the individual time entries on your legal bills.

Lawyer time entries: a window to the soul.

It’s been said that the eyes are the window to the soul. But it’s not looking into someone’s eyes that reveals that person’s soul, it’s what that person’s eyes are fixed on. So how can you tell whether your attorney is looking at your interests or their own interests? It’s in the individual time entries.

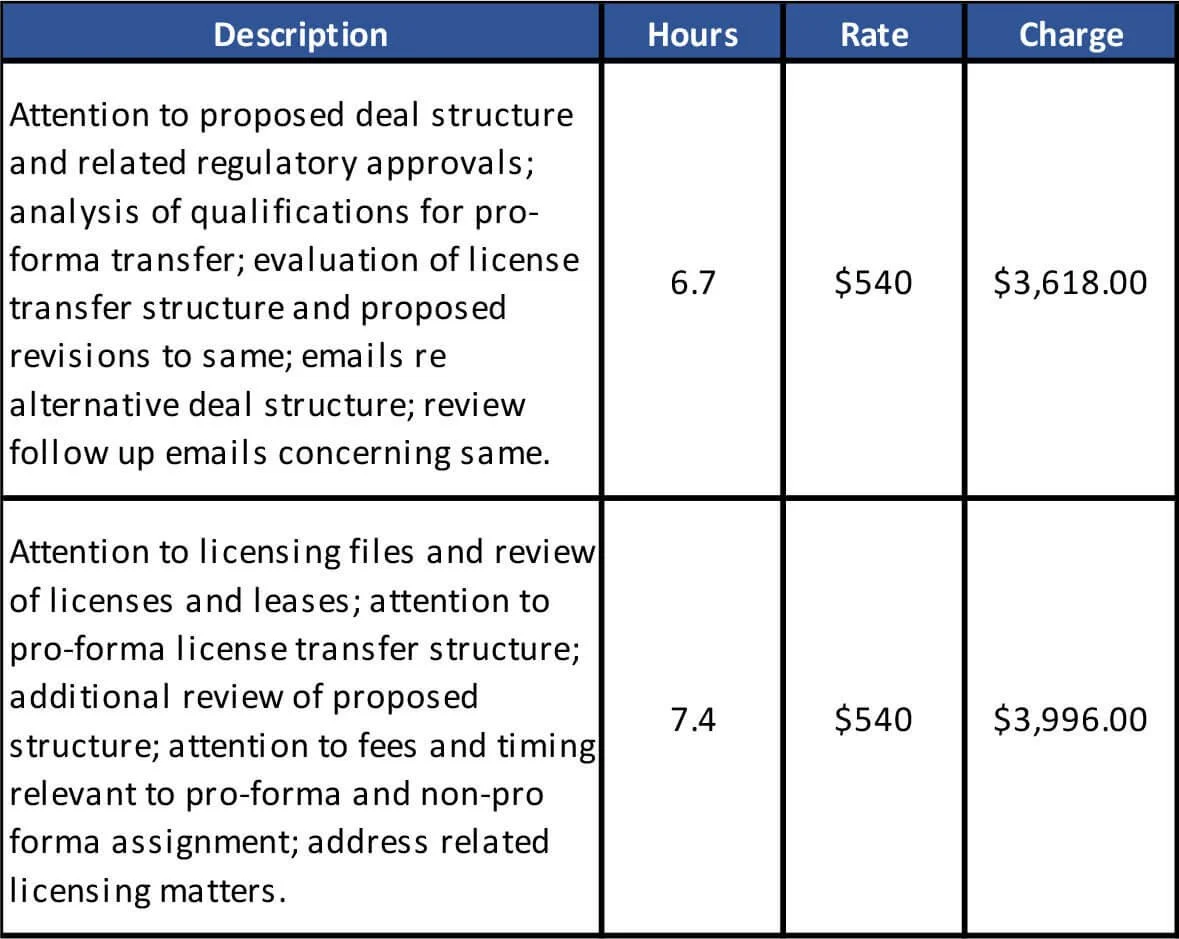

Here are two actual entries for the same client by the same associate for two consecutive days.

These two time entries account for 14.1 hours of the more than 100 hours this associate billed to the client in seven weeks. The client was charged more than $54,000 for this associate’s time.

At first glance, it appears that this associate has done a lot of work for the client. But notice that the task descriptions are all nebulous: “attention to…; analysis of…; evaluation of…; emails re…; review follow up emails…; attention to…; attention to…; attention to…; address...” And NO actual work product was produced in that 14.1 hours of time. Whether this associate was reconstructing his time at the end of the month or had more sinister motives, this time entry screams: “I need to fill my time card!” This lawyer’s eyes are not fixed on the client, they are staring at an empty timesheet and the consequences of failing to meet his required minimum billable hours.

Why are inadequate descriptions indicators of potential overbilling? Lawyers are, more than anything else, professional writers. You would not want an attorney drafting your contract who could not precisely state the intention of the parties and the terms of the agreement. So why would a lawyer not also be precise in describing the work he or she did on a client’s behalf? Most businesses go out of their way to identify the value they deliver to their customers, unless they are not delivering value. Vague descriptions suggest exactly that: the attorney is not delivering value to the client.

And where was the billing attorney, who should have reduced these charges before this invoice was sent to the client? First, the law firm makes more money, and the billing attorney makes more money personally, when the associate overbills. Second, the billing attorney’s time entries were similar (“focus on. . .; review. . .”).

Perhaps the billing attorney made partner by entering hundreds of valueless hours every year.

NO actual work product was produced in that 14.1 hours of time.

There are numerous other billing practices that lead to inflation of legal invoices.

In addition, these time entries are classic examples of block billing. There are five different tasks stated under each entry. The California Bar Association did a study on attorney billing issues and found that block-billed time entries typically equate to a 10 to 30 percent inflation in the actual time worked by “camouflaging noncompensable tasks” within large time blocks.⁷

There are numerous other billing practices that lead to inflation of legal invoices, such as using high-rate attorneys for tasks that can be done by entry-level attorneys or paralegals⁸, billing for multiple attorneys to participate in intra-office conferences with each other, billing for overhead items like copying and printing, charging paralegal rates for an administrative staff member to transcribe a lawyer’s dictation, charging for a junior lawyer’s training (usually the client is charged for both the senior and junior attorney’s time), doing unnecessary and/or unauthorized tasks, and, of course, recording more time than a task actually took, or should have taken.

⁷ California State Bar Association, Committee on Mandatory Fee Arbitration, Arbitration Advisory 2016-02. March 25, 2016. http://www.calbar.ca.gov/portals/0/documents/mfa/2016/2016-02_Bill-Padding_r.pdf ⁸ As one court quipped, “Michelangelo should not charge Sistine Chapel rates for painting a farmer’s barn.” Ursic v. Bethlehem Mines, 710 F. 2d 670, 677 (3rd Cir. 1983).